In a first post, the author looked at the importance of the sustainable development of small and medium enterprises (SMEs) as a cornerstone to economic development: they create the most jobs (in volume), generate the most value-added and, though not covered in that post, they diversify the economy to be more resilient in the face of shocks.

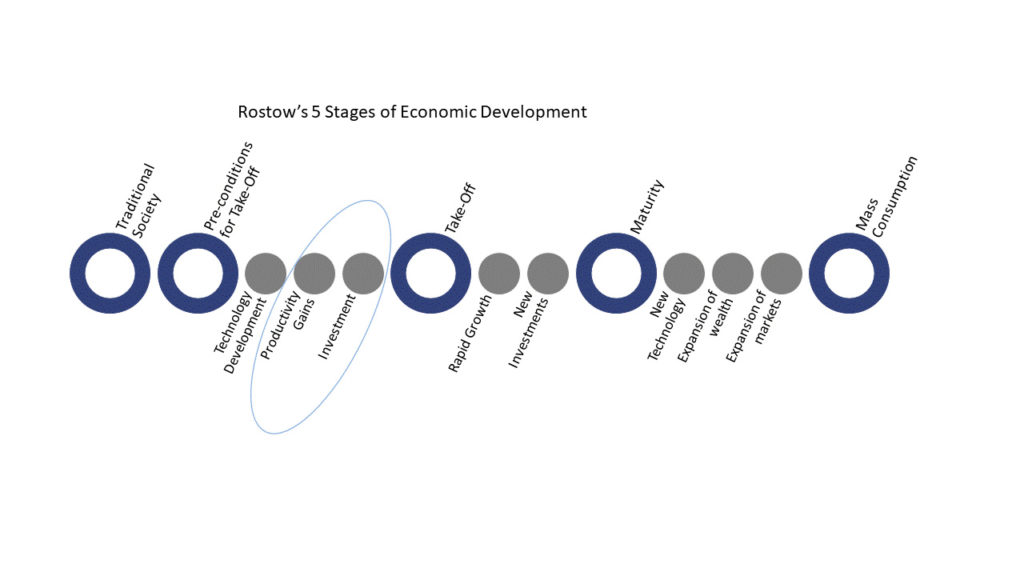

Yet, looking historically, before SMEs can take hold, the world’s most successful transitions from poor-commodity focused economies to industrialised societies came from productivity gains in agriculture. The capacity to provide quality food at a lesser price to a country’s population has been a consistent driver of Rostow’s famous “take-off” of economic growth.

Macro-economic theory explains this phenomenon quite succinctly: better quality food leads to healthier populations that live longer and more productive lives, and its decrease in cost leads to excess liquidity which can be piled into short-term (housing, medicine), mid-term (care of the elderly, children), and long-term investments in the future (savings in financial institutions or into self-owned enterprises).

This phenomenon is by no means linear, several countries saw economic development in the XXth century without going through an agricultural revolution, leading economic development scholars to question whether it is THE key to take-off. Globalisation, allowing people to have similar access to better quality food in higher quantities and lower costs, further puts in doubt whether increased agricultural productivity is a necessary pre-condition. Also, some scholars argue that increased investment in agricultural output can crowd industrialisation out (sometimes described as the “Dutch Disease”).

This article does not say that focusing on agriculture is the “catch-all-end-all”, but there are examples in the XXth century showing development can come from agriculture: Brazil has always had strong agricultural output, but it is only when the country started to export excess agricultural goods that industrialisation materialised. India remained a traditional society until the 1970s when agricultural output exploded, and incidentally the People’s Republic of China only started its generational growth sprint when the country stopped needing food aid from the rest of the world. These examples incline the author to believe that agriculture remains an important lever to development, which must be suitably managed at a macro-level to leverage growth.

Looking at the African continent, many, though clearly not all, countries of the continent have the resources (land and persons) to utilise this lever. Yet no one African country has leveraged agriculture to achieve development, with the caveat that certain countries have high value crops that are exclusively for export: cocoa in Ghana and Côte d’Ivoire spring to mind. But if relying on one crop were sufficient, mono-culture of cotton in Central Asia or coffee in Colombia would have led those countries to development. It hasn’t. Instead, growth in Central Asia has come in large part from extraction industries and remittances, Colombia’s economic development has certainly been fuelled by coffee, but it is the country’s overall diversified economy that has been most useful.

Thus, availability of resources does not automatically lead to productivity, and concentrating on one crop is not sufficient. Though probably not the main issue at play, let us look at financing agriculture to see if there is a gap than can be filled by FS Impact Finance.

Successfully providing agriculture finance requires a particular set of expertises – indeed a microfinance institution that mainly caters to actors in the trade sector (short grace period, short maturity, equal weekly/monthly instalments) cannot roll-out the same products to farmers. First and foremost, agriculture finance requires a certain understanding of crops and their growth cycles in the year – let us take the following, as examples:

- Tomatoes can grow between temperatures of 8° to 36° C and humidity levels between 40% and 60%. The process from seeding to flowering averages between 65 and 85 days, once the plant has flowered production of tomatoes takes between 35 and 50 days, year-round (provided the climate conditions are present). Seeds for replanting can be extracted from a small percentage of the crop.

- Corn requires much sun and warm temperatures, best suited in the temperate climates for the summer and fall, year-round in sub-tropical and tropical climates. The process from planting to harvest lasts between 60 and 135 days (depending on the variety), after which the crop must be replanted. Seeds for replanting can be extracted from a small percentage of the crop.

- Pineapples develop in tropical (hot and humid) climates and take between 14 and 18 months to grow, with a single plant being only capable of providing one fruit, while providing future saplings that will themselves provide one fruit. This makes pineapples a land-devouring crop.

These basic parameters further do not take into account soil quality, prevalence of natural events (i.e. heavy thunderstorms in tropical rainy seasons, lack of sunshine in equatorial dry seasons) and specific climactic conditions that impact the different growth stages of each crop.

All of these conditions impact production levels and financing needs of the clients, that a microfinance institution must understand. Further, the MFI must understand what the finance is required for:

- financing for inputs (seeds, fertiliser)

- financing to cover day-to-day living expenses between harvests

- financing of the harvest (renting of farm equipment or hiring manual labour)

Just as important, understanding of the market conditions in which farmers operate must guide the product design: prices for long-cycle crops are typically lowest at harvest, and highest at in between, exactly the opposite of what a farmer producing such crops would need.

There exist numerous agri-finance specific products, and as long as they take these (and other) points in perspective, they will meet the needs of the farmers looking for them, but few MFIs do.

Let us now take a quick look at how some farmers concluded that they were best served by themselves.

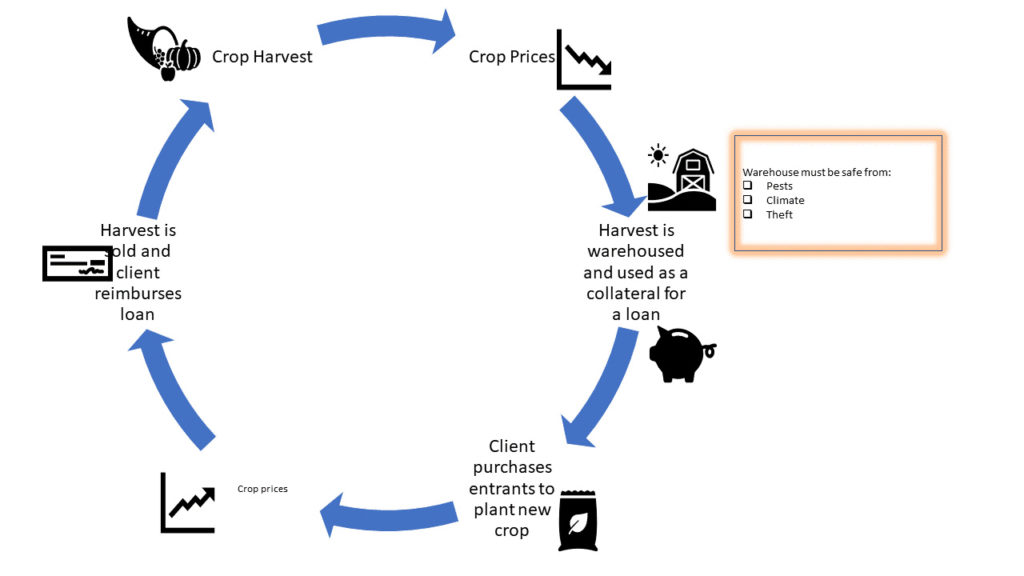

In line with a culture of the collective, small-holder farmers in West and Central Africa saw the opportunity of banding together, so many created cooperatives to leverage expertise, obtain cheaper inputs of seeds and fertiliser thanks to economies of scale, and sell their production further away by lowering marginal transportation costs (combining their production). Some of these cooperatives added financial components to their combined efforts: savings and credit cooperatives allowed members to access financial products and smooth the periods during which they needed money (seeding and harvest) and periods where they had money (post-harvest). Better land-use and development of new crops allowed for increased yields and more turn-over (with shorter crop growth cycles). Warehouse finance also helped smooth supply/demand effects on non-perishable crop prices1.

These cooperatives have not been successful in achieving scale. While many professionals in microfinance believe this comes from a lack of expertise, the problem generally does not lie with the cooperative’s expertise – many, small, institutions have mastered the complicated nature of this business model. But this business model is expensive, and returns are slow, and other unspecialised actors have not sufficiently looked at what make it work. Thus, cooperatives, and other small institutions, have not had the resources or the exposure to refinance themselves, limiting what they can provide to their clients.

There remains vast potential of agricultural development in Africa, across a range of crops, for local consumption and for export, but available, appropriate finance has been a recurring issue. And while the continent is populated by a large number of microfinance institutions that possess the expertise to provide the right financial tools to allow these farmers to grow, they are generally too immature to access finance and achieve scale.

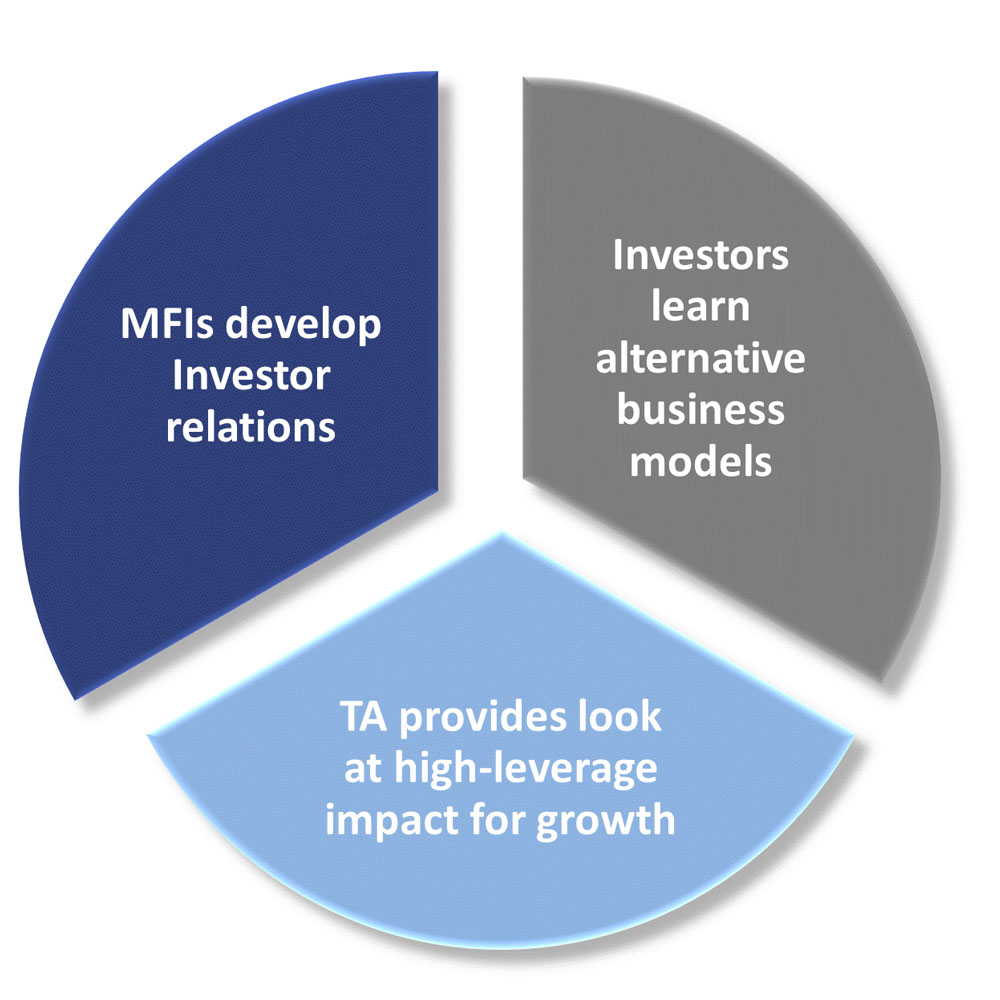

While there have been a number of international development initiatives, they have not been what the sector needed.

- Investors (private or public) look for high leverage effects: they want the biggest bang for their buck while maintaining a moderate risk appetite, and small institutions do not present that case.

- Technical assistance providers have expertise in the specificities of agriculture finance, which many of these small institutions already have.

- Small agri-focused institutions are in rural areas, doing what they do well, but isolated from the rest of the world.

The answer is obviously threefold:

At FS Impact Finance, we look at each individual case on its own merits, and while some investments make more short-term profit-sense than others, we look at high growth opportunities, including with less mature institutions that provide valuable products to their clients.

Footnotes

1Warehouse finance consists of storing non-perishable goods in a safe place as a collateral for a loan, presenting a security for the financial institution. In return, the farmer can use the loan to purchase inputs for the next harvest, and sell the harvest once the market has absorbed the excess supply and prices go up. The difficulty in this product is in the warehouse: it must be safe from pests, climactic events and theft for the harvest not to lose its value (damaging the farmer’s assets and the lender’s security) – these types of products require upfront investment.