Our journey to impact measurement and management

After joining the Global Impact Investing Network (GIIN) and thereby connecting to the worldwide community of impact investors, FS Impact Finance is proud to announce to have become a signatory to the Operating Principles for Impact Management. Initially developed and hosted under the umbrella of the International Finance Corporation (IFC), the Impact Principles have recently moved to the GIIN as new host having a wide expertise in impact measurement and management (IMM) and longstanding experience in the development of industry data standards, methodology, benchmarks and guidance on impact investing practices. Just as this step was a natural evolution for the Impact Principles, so it is for FS Impact Finance.

Aside from being part of a community of 170 investors spanning 38 countries and targeting impact with cumulative assets of US$510 billion, a primary motivation for FS Impact Finance to become a signatory is to increase accountability, effectiveness and transparency in our operational efforts to contribute to a more sustainable planet and a more equitable world.

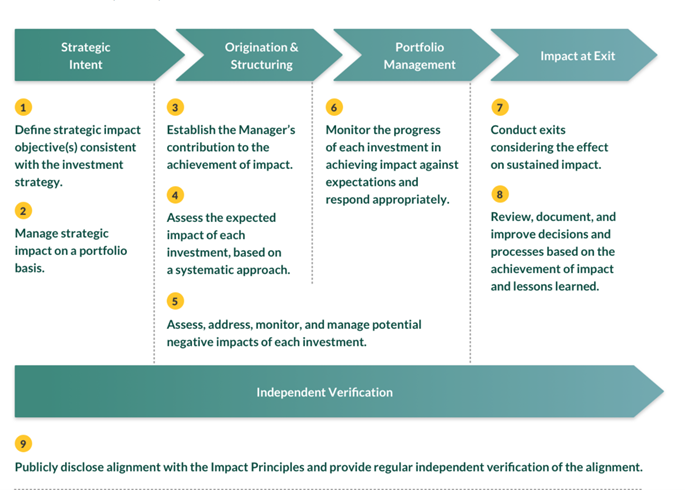

Putting the 9 Impact Principles into practice

For several reasons, the 9 Impact Principles provide a stringent and consistent path to IMM, which reinforced our decision to sign on to them:

- Develop and assess the impact story: Impact measurement and impact management start with the primary intent and are the foundation of all impact stories. They build on the definition of impact objectives and how affected stakeholders should benefit from the results by linking them to the investment strategy.

- Improve decision-making – refine impact intentions: Integrating our investment activities into an overarching IMM framework can both lead to more accurate and reliable information about our impact and help identify and prioritize strengths as well as areas for improvement. It enables the overall investment process to identify the issues that are most important to stakeholders as contributing to our overall impact goals.

- Improve stakeholder engagement: An IMM system may provide a framework for engaging our stakeholders, specifically the communities in which we operate. This can help identify the most important issues for stakeholders and enable them to contribute to the our impact.

- Manage potential reputational risks: As it is the case with other investment activities, impact investing carries the risk of reputational damage if investments do not achieve promised impact goals. It also underscores an awareness that impact investing can have unintended consequences. With this in mind, we strive to minimize reputational risks at an early stage in order to achieve long-term impact.

- Achieve positive impact and talk about it: The mandatory Disclosure Statement combined with Independent Verification will help us as a signatory to put our IMM into a structured format and share it with our stakeholders. Simply, because there is no such thing as talking too much about impact and how it may be achieved with the greatest possible benefit.

Further to this, FS Impact Finance is committed to the Impact Principles and looks forward to being part of a group of signatories focused on impact. The development and further improvement of our IMM system is an important and consistent step in our journey to become an impact investor that sees impact as a guiding principle for both its business and operations.