Part II: Spotlight on investing in loans versus buying bonds

As usual, one can complain about a lot of things in capital markets – at any time. But one of the few things surely no one can complain about was a lack of volatility in the first half year following the outbreak of the global Covid-19 pandemic. It is surely not our intention to simply ignore the hardship, the economic devastation and the loss of lives the pandemic has created as it will continue to affect every nation on this planet to various degrees for the remainder of 2020 – in a best case scenario. But as it is also deeply embedded in the nature of mankind to learn and to grow from crises, we simply want to point out to some specifics and market mechanisms, that usually are rather academic but which came into effect in real life throughout the market turbulences that have been observed.

Quick market recap and word salad

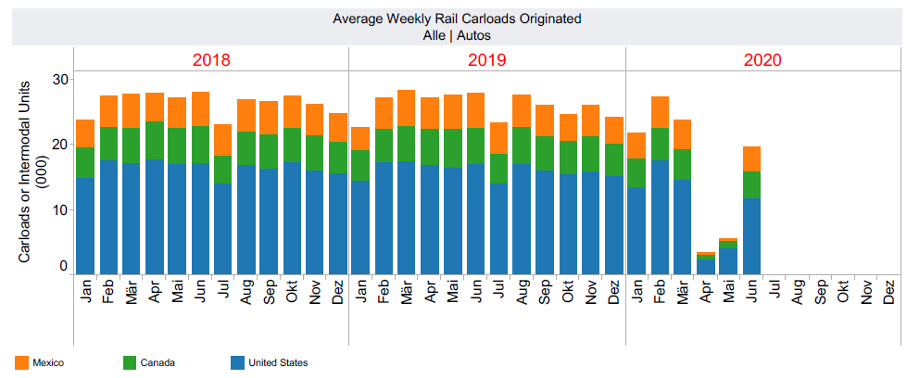

As we from FS Impact Finance are not standard equity investors (and haven’t aimed for that), we do not question the wisdom of equity markets. Being well aware of the difficulty to provide reasonable macroeconomic forecast in such a challenging environment in the middle of a global pandemic, it is by no means to be ruled out that equity markets did anticipate the path back to normalcy and out of the lockdown, quite well. Keeping in mind the unprecedented liquidity injections from central banks around the globe plus the corresponding fiscal stimulus packages plus the massively increased use of digital technology during lockdown, there is a well-funded argument for the recovery of especially tech-stocks after the shock reaction in March 2020. The severity of the decline in economic activity can be shown by the railway freight rates for U.S. cars in North America: the chart gives a pretty good impression of the impact on car sales as well as on car production in these times and might also serve as a proxy for the impact of the lockdown on the manufacturing sector in general. So, as stock markets as well as transportation segments point to a potentially rather quick recovery1 that translates into the so-called V-shaped recession – which assumes that the global economy takes a massive nosedive, but then returns to almost previous levels just as fast – the more pessimistic view is a second leg, so another deep dive of the real economy which would transform the V into a W and so on. (Source: https://www.aar.org/data-center/rail-traffic-data/)

In order to complete the word salad, the L-shaped and U-shaped recoveries were circulated especially in the beginning of Q2. Again, it needs to be clearly stated that given e.g. forecasts from OECD2, this will surely not be a mild recession as most recent (July) forecasts envision a double-digit drop in the Eurozone of -11,5% drop in GDP with all its negative repercussions on people and societies.

Why does it matter to fixed income investing at all?

To be cynical, one might state that the only thing that matters in developed securities markets these days are the measures taken by the central banks – may it be from the equity or the fixed income perspective. We discussed that already in part one – here. As central banks surely have been and continue to be the main driver of the global low to zero yield environment with all corresponding knock-on effects, absolute yield levels around zero continue to be rather a privilege for the developed markets, hardly observable in the emerging market sector. As now this rather special monetary policy gets combined with expansive fiscal policy, the asset prices react accordingly in developed markets.

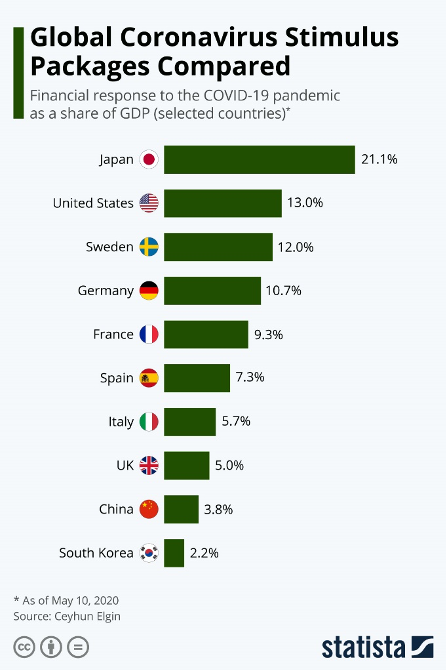

As emerging market countries have much smaller public budgets anyway (whether measured in absolute terms, or per capita), the fiscal stimulus to be given by the central government in times of a severe crisis is by definition lower and so political leaders simply do not have the financial means to help their citizens to better cope with the effects of the global pandemic.

Let the games begin

As the pandemic-induced turmoil in financial markets for Europe and North America started at the end of Q1 2020, it was basically a repetition of previous crisis script, this time with exceptional volatility and economists trying to become better virologists within days or weeks. Bid-offer rates widened, risk-taking turned into risk-reducing behaviour and the ability to trade large volumes was limited for institutional bond investors – so despite a virus spreading across the globe surely being a unique trigger for the market turmoil, the actions of market participants as well as well as price changes observed in the securities markets have generally not been unorthodox or exceptional3 compared to earlier crises. The lessons to be learned at least for us rather came from the loan side: Almost out of the blue, without lengthy negotiations and in the height of the lockdown, the IMF / World bank announced a debt relief programme for the 77 poorest country of around 12bn USD. This relief scheme quite nicely shows that loan lenders (like IMF or World bank) are not in a position to sell or assign their loans as fast as bondholders can quit their positions – but they have much more leeway when it comes to renegotiating their loan conditions. At the end of the day, this flexibility might deliver the edge when looking at the return of the investment or the ability of the borrower to stay afloat in turbulent times. Both abilities to either exit a (bond) position fast or to amend an existing (loan) position quite flexibly may be more advantageous in different market circumstances.

In order to not paint those boring black-white pictures, it is fair to state that there are also bondholder conventions, but in terms of calling together bondholders (bond issues being really placed in the market, having actively traded, etc.) in a way to satisfy also minimum voting capital requirements, the loan side at least to us offers often more flexibility here. Besides, bondholder conventions also take place quite frequently in default or restructuring cases4, when the original bondholders having subscribed to the bonds previously at par is usually no longer the current bondholder getting invited to such bondholder meetings. Fun fact on the IMF / World Bank debt relief scheme mentioned before: The big credit rating agency Moody’s threatened countries willing to take part in it with downgrades – as it would increase the probability of additionally inflicting losses on private bondholders to the same extent5. While this is not the place to discuss the general wisdom of credit rating agencies, we still would look at the first-round effects first, i.e. borrowers getting temporary debt relief without a corresponding quid pro quo, which should basically reduce their probability of default. With the poorest countries of the world not changing on a weekly basis, we do not subscribe to any kind of negative signalling effect or reputational effects that outweighs always and in every case the positive effect of such a debt relief outlined. We also want to point out to the standard textbook wisdom that credit rating agencies can never fully replace your own credit quality assessment. They might accompany a good credit assessment process but like all man-made judgements, they are prone to mistakes from time to time as well, see the fines for Scope ratings from ESMA just recently6.

Covid-19 and loan business – throwing good money after bad money?

To be fair – the judgement is out every time, when the previously and contractually agreed cash flow structures are amended at a later stage. But the mechanic seen behind the restructuring of loans to microfinance institutions (MFIs) in the course of the Covid-19 pandemic is truly amazing – in a positive way. As various countries issued moratoria and branches that used to collect e.g. the instalments from microentrepreneurial clients on a weekly basis simply had to close down due to public order, the cash inflow on the asset side got interrupted heavily which would over time correspondingly lead to disruption in the payment schemes to lenders of MFIs. Institutions with deposits where faced on top with a sudden and unexpected withdrawal of deposits, especially by retail clients.

As the balance sheets of MFIs tend to be rather simple and transparent in contrast to e.g. European Commercial or Investment banks, they also rely much more on growth (in assets, funding and capital) as well as on a comparatively high turnover in its funding due to the short tenor of the loan business on the asset side. But as Covid-19 has sometimes almost overnight stopped the loan business of MFIs, it immediately created pressure on the liability side as maturities come up rather quickly with average initial loan tenors being mainly in the range from 2 to 4 years. So major investors / lenders in the microfinance space came up with principles of how to deal with MFIs seeking financial assistance quite quickly7.

Notwithstanding individual issues on the level of the MFIs, country-specific issues like duration of national moratoria and other factors of influence – the impact investor community reacted flexibly and sufficiently effectively to the needs of MFIs in these turbulent times. Upcoming maturities have been rolled over to a large extent, mainly for some 6 to 9 months in order to get better visibility and to decide after that period about how to proceed. So in this context, one might tout this as a kind of positive moral hazard play – all investors usually agree to roll-over their upcoming instalments for the same period of time, thereby not changing the hierarchy or timely subordination of the liability side plus pre-emptively avoiding the liquidity crunch on the MFI. The major advantage in our view is that loan negotiations in the MFI universe tend to have a pre-emptive nature in order to avoid a nearing default or liquidity crunch. In securities trading / investing, we would assume that the vast majority of bondholder negotiations on shifting principal and interest rate payments takes place after any kind of restructuring or insolvency procedure of the bond issuer.

The interesting question surely remains how the different types of lenders to the MFIs manage their liquidity and react on the (loan)portfolio level when the previously and contractually agreed payments do not come in as planned at the time of the loan disbursement. We would like to point out to the different nature in the impact investor space in this regard, namely the co-existence of closed-ended and open-ended microfinance funds, but that topic surely deserves a blog contribution on its own. Stay tuned!

Footnotes

1 Fun fact: The drop in equity market plus the recovery of prices that follows until summer 2020 was by standard definition the shortest bear market in recorded history as the drop was well beyond -20%, only to get killed by the bull stampede with a performance of X in the y index, which defines by coincidence again a bull market with a rise >20%.

2 To be found here: https://data.oecd.org/gdp/real-gdp-forecast.htm

3 True, e.g. oil prices turned negative in 2020 for a very short time, which surely is another expression for the exceptional phase of the lockdown period, but in all fairness, that was just one particular sort of oil that caught the headlines while all other sorts of oil due to the storage situation did not turn negative and it generally did not end up in a way that consumers received cash for filling up their cars. So: Absolutely remarkable, unheard of before, but corrected within days.

4 We recommend e.g. to check in the case of Argentinian government bonds.

5 See e.g. https://www.ft.com/content/7d51d373-c12e-4440-a408-e61a939e3a3c

6 https://www.esma.europa.eu/sites/default/files/library/esma71-99-1338_scope_ratings_enforcement_action.pdf

“In both instances Scope committed the infringements negligently and failed to meet the special care expected from a credit rating agency (CRA) as a professional firm in the financial services sector.”

7 See e.g. https://www.3blmedia.com/News/Pledge-Protect-Microfinance-Institutions-and-Their-Clients-Economic-Effects-COVID-19 or here https://www.ada-microfinance.org/en/blog-news-ada/details-news/2020/05/an-international-coalition-to-protect-microfinance-institutions-and-their-clients-in-the-covid-19-crisis