Carbon tax is a fee imposed on the burning of carbon-based fuels (coal, oil, gas)1. Many economist and scientists regard it as an incentive to reduce the use of fossil fuels and an instrument for governments to reduce emissions, fight deforestation and promote social development.

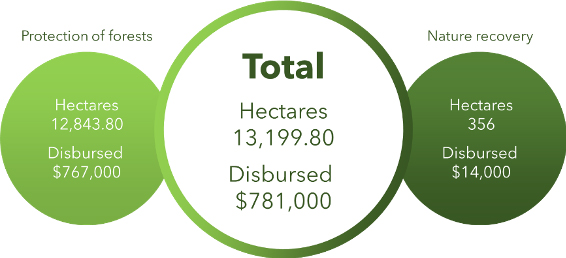

Costa Rica implemented a carbon tax in 1997. Fossil fuels since bear a carbon tax of 3.5%2, generating USD 26.5 million in revenues each year3 used as an economic tool to protect mature forests and to restore forest land. Based on the forest law no. 7575 article 46, the Costa Rican government founded the National Forest Financing Fund (FONAFIFO)4, an entity created to invest the revenues collected through this tax. FONAFIFO’s objective is to finance small and medium-size farmers and landowners, through credits and other mechanisms to promote forest management, forest protection, reforestation, plantations, natural regeneration and agro-forestry. The fund has disbursed around USD 500 million to roughly 18,000 people such as farmers, women living in rural areas, wood producers, small eco-tourism ventures and micro-enterprises. The investments contribute to protect 1 million hectares of mature forest and 71,000 hectares under reforestation5. Part of the tax program are incentives targeting biodiversity conservation and sustainable use. Owners of natural, protected or replanted forests are exempted from property taxes under the 1995 Property Tax Law6.

In the 1980s Costa Rica had the highest deforestation rates in the world, at around 3.6-4% of land deforested per year.

Costa Rican Ministry of Environment and Energy, Report on the State of the Environment 2017, 2018.

Carbon tax: a politically debatable solution

A carbon tax aims to fight climate change; however, it is a highly controversial topic. Some arguments against it are “leakage” – meaning the displacement of deforestation to other areas, its limited effectiveness to incentivize emission reduction through renewable energy, the difficulties to measure pollution and to collect the tax, the idea that firms could feel encouraged to move their production to other countries without the tax and the possible misuse of tax returns.

Nonetheless the Costa Rican case highlights some of the positive impacts that a well-managed carbon tax can offer: with the right governmental organizations in place the revenues raised can be spent on mitigating greenhouse gas emissions through appropriate projects, motivates firms and communities to improve its natural surroundings and profit from the benefits of green investments, makes polluted products more expensive and less attractive to the market, and even enabling social development in rural areas.

In Costa Rica forest and high levels of poverty can often be found in the same districts. The economic benefits of the carbon tax are earmarked to fight deforestation as well as to promote social development of rural poor communities. Assisting smallholder farmers and indigenous communities is a reason why the government prioritizes such districts for payouts. Today, 40% of beneficiaries are in communities that live below the poverty line.

Source: FONAFIFO, Rendición de cuentas 2019

Conclusion

Carbon pricing is increasingly recognized as an essential instrument to cost-effectively deliver the transition to low-carbon societies7.

IPCC, Global Warming of 1.5°C, 2018.

Most people would agree on the urgency to stop deforestation and to promote reforestation. For Costa Rica the implementation of a carbon tax in combination with tax incentives and forest conservation measures is proof of the positive changes that a country can achieve in 30 years. However, as in most things in life, no solution fits all, each government must decide which actions need to be taken to achieve its own social and environmental goals in order to reduce greenhouse gas emissions and mitigate climate change.

Note:

At the recent World Bank Group Spring Meetings, Finance Ministers from more than 20 countries endorsed the “Helsinki Principles,” which promote national climate action mainly through fiscal policy and the use of public finance. Governments raised approximately USD 44 billionin carbon pricing revenues in 2018, with more than half generated by carbon taxes. This is an increase of nearly USD 11 billion compared to the previous year8.

Footnotes

1What’s a carbon tax? Available at: https://www.carbontax.org/whats-a-carbon-tax/

2 Set at 3.5 percent of the market value of fossil fuels – World Bank Group, Putting a Price on Carbon with a Tax

3 Edward Barbier and Sebastian Troëng, Carbon taxes are key to stop deforestation, published on February 13, 2020. Available at: https://www.climatechangenews.com/2020/02/13/carbon-taxes-key-stop-deforestation/

4 Official website: https://www.fonafifo.go.cr/

5 Edward Barbier and Sebastian Troëng, Carbon taxes are key to stop deforestation, published on February 13, 2020. Available at: https://www.climatechangenews.com/2020/02/13/carbon-taxes-key-stop-deforestation/

6 OECD, Accession Review of Costa Rica in the Fields of Environment and Waste Summary Report, 2020. Available at: http://www.oecd.org/officialdocuments/publicdisplaydocumentpdf/?cote=ENV/EPOC(2019)18/FINAL&docLanguage=En

7 IPCC, Global Warming of 1.5°C, 2018.

8 World Bank Group, State and Trends of Carbon Pricing 2019, 2019. Available at: https://openknowledge.worldbank.org/handle/10986/31755