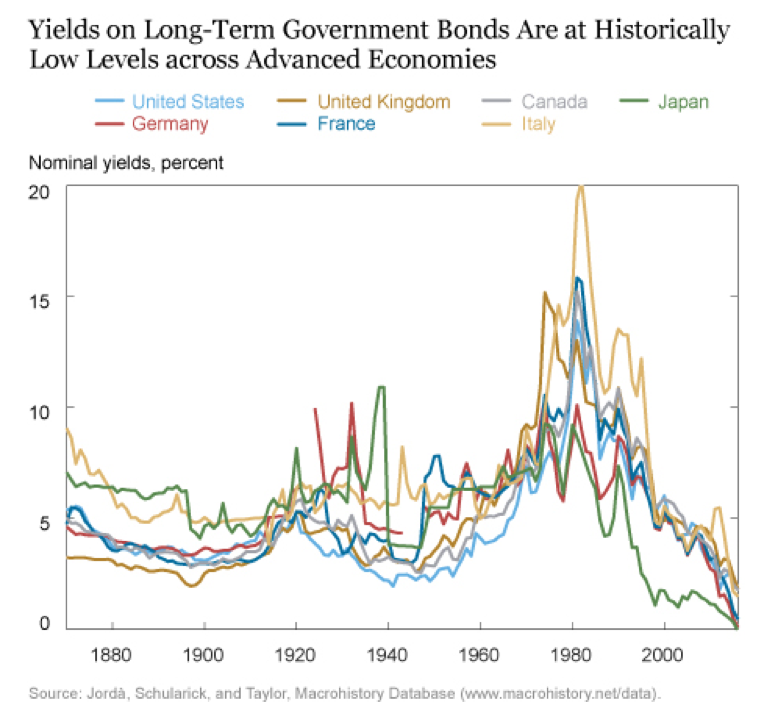

There seem to be rather good crash barriers on each side of the investment path for fixed income investors in developed markets as there are two very basic idioms: “Don’t fight the central bank” and “bad news is good news”. The latter one is obvious and presented in every standard book on monetary theory, as bad (macro-)economic data simply increases the probability for the next interest rate cut. This would in turn increase the net present value, i.e. market price of existing fixed income holdings in government bonds. Obviously, negative news on individual companies surely have the potential to drag on corporate bond prices.

Is growth always good? For all?

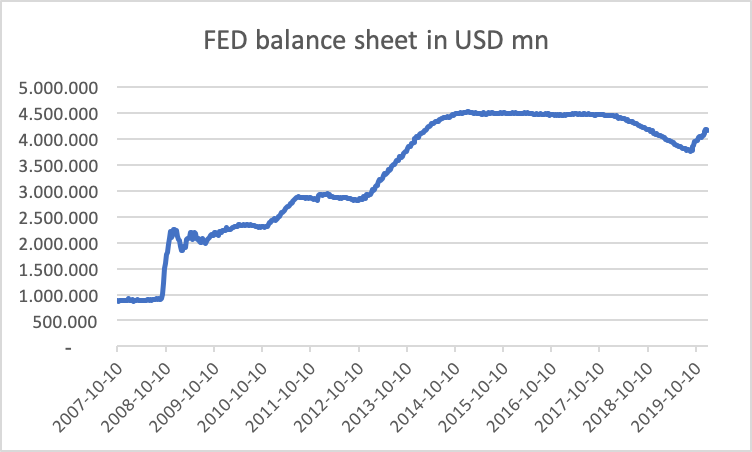

The reason for not fighting large central banks is also quite obvious by simply looking at recent developments of the US Federal Reserve (FED). In the aftermath of the Lehman insolvency, the FED’s balance sheet was extended from a “mere” 800 billion USD to almost 4.5 trillion USD –an inflation by a factor of 5.6 at its heyday, hardly matched by GDP growth in the same period.

Negative interest rates – just in case simply buying assets is not enough

The amount of central bank interventions, e.g. purchases of government bonds, obviously varies in countries like Switzerland, Japan or the Eurozone, but there is another instrument which shows the determination of central bankers to steer markets in the supposedly “right” direction – negative interest rates. As negative rates can be interpreted as a tax on holding a cash position, they severely change the risk and return maths for fixed income investors. Two standard reactions usually emerge from the pressure of paying a fine to hold cash: trying to reduce costs (e.g. change from active to passive management of investments) or taking on more risks – which seems to be the ultimate aim of the central banks’ market interventions.

Getting started

So, what has to be taken into consideration when trying to escape traditional currency areas with negative yields? Again, looking at standard textbooks, the usual issues are:

1. Liquidity

Looking at the average volume of government bond issues out of emerging markets and the corresponding trading volume compared to developed economies, this is almost self-explanatory. Accordingly, the ticket size needs to be adjusted.

2. Rating

As some question the utility of credit rating agencies after their performance at Enron or Worldcom, still structured finance and other previously fancy candidates deserve to be checked. As a general remark, it is probably a pathetic idea to invest in emerging markets with major rating restrictions.

3. Currency & capital controls

When trying to capitalize on the higher levels of interest rates in emerging markets, it is sometimes mouth-watering to look at absolute figures. Taking into account potential hedging costs, the picture is less bright, though. Being confronted with potential capital controls or sanctions, there might be obstacles to bring home the money which invested abroad.

4. Lack of hedging

Amongst other market imperfections, one is confronted on many occasions by the lack of perfect hedging instruments. As credit default swaps have already proven to be problematic in the post-Lehman world, there are no suitable and liquid futures or swaps for the majority of high interest rate countries. If selling a position is considered as a hedging tool, remark no.1 comes into play again. So, quite often being long and hoping to not be wrong is the investment reality.

Come to where the yield is!

Just to give a brief outlook on the possible total return when investing in emerging markets and also for whetting your appetite for part 2 of this blog series, take a look at the 8,875% Ecuador 2027 bond – come to where the yield is!

Why we chose this bond

We chose this bond for various reasons:

- Bonds per se are easier to discuss, compared to making loans to borrowers in emerging markets.

- It excludes currency risk for the investor as it is quoted in USD (which is not fully true as the State itself might lose its access to USD during the lifetime of the loan (but that’s a different story).

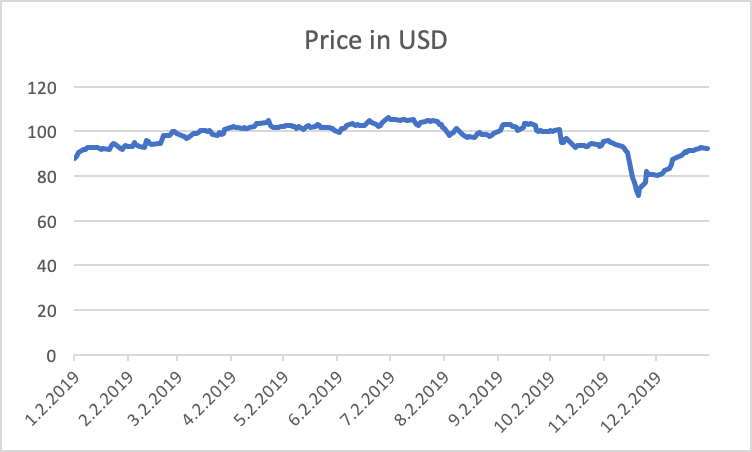

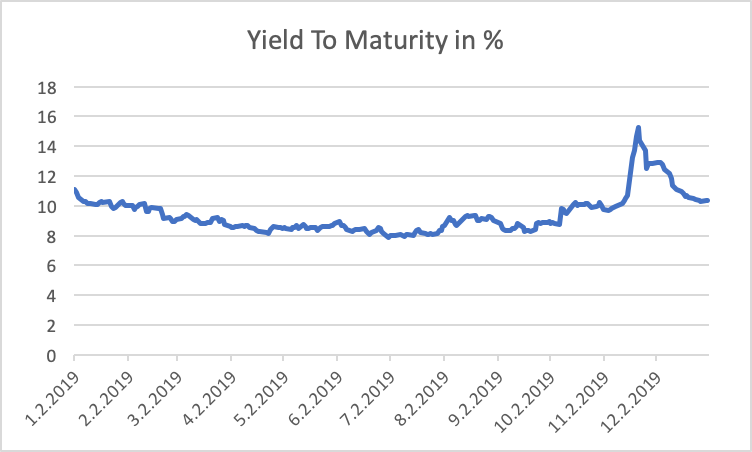

- It highlights the political risk in emerging markets: the riots in Ecuador started in the first days of October and culminated in a general strike on 10th October, the price reaction until then was a drop from 100 to mid-to-low 90’s which can be interpreted as one annual coupon, but the real “fun” just started in mid-November, when the parliament rejected the IMF rescue package.

- Investing in emerging markets is about timing and being able to handle volatility. It is not inconceivable, that e.g. a downgrade occurs as a consequence of the parliamentary hustle in mid-November and investors in turn become forced sellers at the worst possible point of time. Investors having subscribed to the bond at face value are still confronted with mark-to-market losses on the principal, but at least have received coupon payments. Investors from 1st Jan to 31st December have a total return of around 10% while the fictious investor from late September is still in the red. So, a pretty mixed bag and no asset-class specific features besides the usual “buy low, sell high” wisdom from traders and asset managers.

And now just as a small portion of food for thought – the vast majority of sellers in November have been non-domestic investors as this bond surely is a non-domestic instrument. But how many of them received first-hand information directly from Ecuador? How many even of the large institutional investors really have people on the ground in all those countries where politics frequently backfire heavily on asset prices? Can international asset managers with broad access to regional expertise outperform compared to peers without local knowledge? To be discussed in part 2!