Over the past months, the financial inclusion sector has embarked on a journey to face the Covid-19 crisis. On the field, Financial Service Providers have taken measures to face the health risks, lock downs and the economic recession1. They have also formed a global coalition to make their voice heard. Debt providers, investors, support organizations and technical assistance providers had to adapt theirm intervention principles and coordinate their actions2. By signing the Pledge on Key principles to protect microfinance institutions and their clients in the COVID-19 crisis (the “Pledge”), 30 signatories committed to complying with some key principles. Six months after the signature of the Pledge, a working group of signatories3 draws lessons from the implementation of the pledge principles. To what extent have we implemented pledge principles? What have been the major challenges? What lessons do we learn to better face the crisis and be up to our Pledge in the months to come?

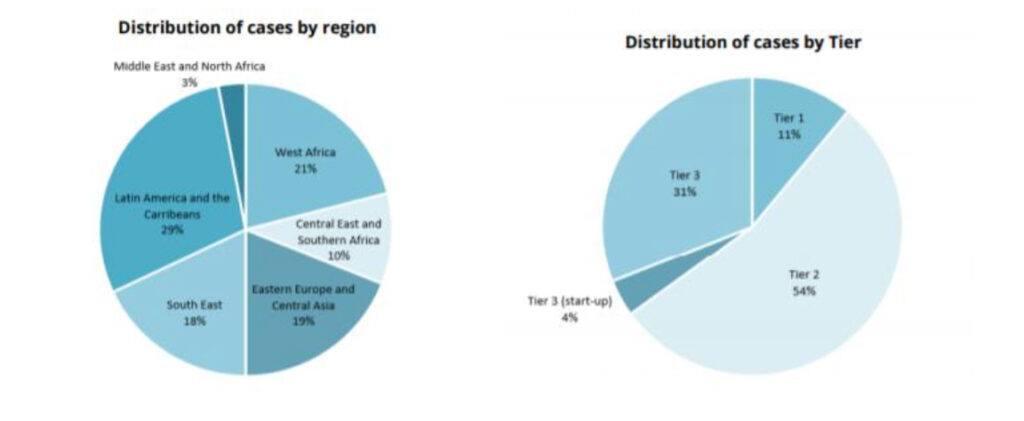

Our working group includes five debt providers, as well as the Social Performance Task Force and ADA as technical assistance coordinator. We have analyzed 70 cases of debt rollover requests and checked to what extent we implemented the Pledge principles. The article focuses on 10 principles mostly related to the approach prior to voluntary debt workouts, as this is what we can observe in the first months of the crisis. These cases span over 6 regions and tier 1, tier 2 and tier 3 MFIs4 as shown in the graphs below.

This article recalls the principles to which we adhered to, provides transparency on the pledge implementation and includes useful lessons and ideas for our industry. Read the full article here.

Footnotes

1 https://www.gca-foundation.org/en/covid-19-observatory/

2 https://www.covid-finclusion.org/investors

3 ADA, Cordaid Investment Management, Frankfurt School Impact Finance, Grameen Credit Agricole Foundation (GCAF), Microfinance Solidaire, SIDI, and the Social Performance Task Force. Disclaimer: examples in the article illustrate how working group participants individually implemented the pledge but do not necessarily reflect the views of all participants or all signatories. 4 Tier definition: Tier 3 = MFIs with a gross loan portfolio below $ 10 mln; Tier 2 = MFIs with a gross loan portfolio between $ 10 mln and $ 100 mln; Tier 1 = MFIs with a gross loan portfolio above $ 100 mln.