Driving new standards for financial players?

The German Federal Financial Supervisory Authority (BaFin) issued their Guidance Notice on Dealing with Sustainability Risks.

Sustainability is more and more a strategic issue, also for BaFin. For this reason, the new Guidance to all BaFin supervised entities like banks, insurance companies asset managers and other financial service providers was issued. Although this Guidance is (not yet!) mandatory, BaFin expects companies to ensure that they address the relevant sustainability risks and document this in an appropriate manner. How these are assessed by the company in an appropriate manner is left up to the individual company following the principle of proportionality.

I deem that this Guidance is also interesting for all other companies addressing sustainability issues, hence the document can be used as a guide also for specialized financial entities like microfinance institutions or even for companies within the industrial or other service sectors. Individual effects on the company’s asset, financial and earnings position must be examined.

The following is an excerpt from the Guidance, BaFin lists ESG (Environmental, Social and Governance) risks in the following risk categories:

Physical risks

- extreme weather events and their consequences

- long-term changes in climatic and ecological conditions

- indirect consequences: collapse of supply chains, climate-induced migration and armed conflicts

- contract partners, causers of environmental damage are held responsible for the consequences by governments or by court rulings

Transition risks

Political measures can lead to an increase in the price or scarcity of fossil fuels and excessive investment costs due to necessary refurbishment of buildings and facilities.

Interdependencies between both risks

The least favorable scenario: extreme climate-induced damages as a result from long delays in energy transition will eventually force a sudden and radical change in the economy

Sustainability risks in the social and corporate governance areas

Events, developments or behaviours associated with social and corporate governance areas may also lead to negative impacts on the asset, financial and earning position of an entity as well as on its reputation, including negative effects on stakeholders of the company

| Credit risk / risk of counterparty default | Market price risk | Liquidity risk |

| Operational risk incl. location | Underwriting risk | Strategic risk / Reputation risk |

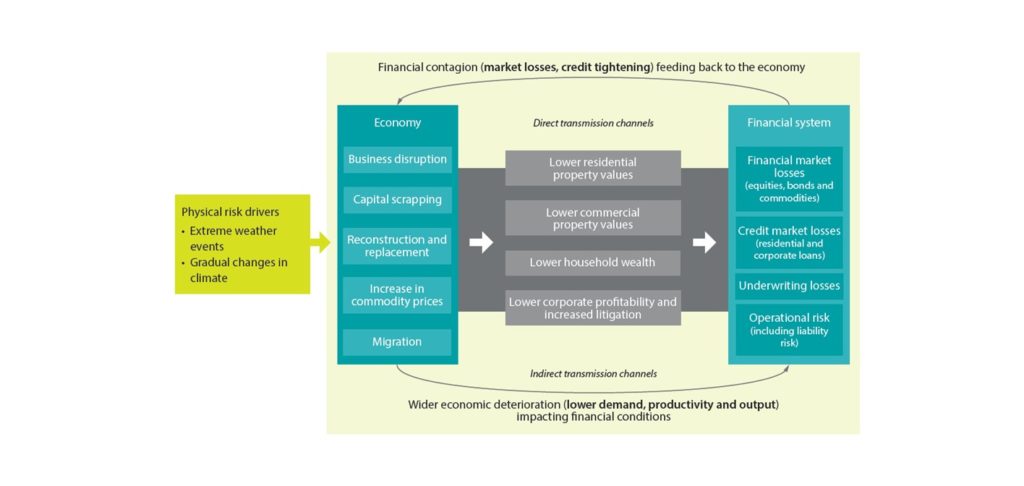

Figure 1: From Physical risk to financial stability “A call for action”, Network for Greening the Financial System / Central Banks and Supervisors), 04/2019

Figure 2 : From transition risk to financial stability risk “A call for action”, Network for Greening the Financial System / Central Banks and Supervisors), 04/2019

Strategies of supervised entities

Review of the business strategy with regard to dealing with sustainability risks (and opportunities, if applicable):

- If external sustainability standards are voluntarily agreed to comply with, ensure that they are in reality met accordingly.

- Which business areas are exposed to physical risk? Risk material? Are impact analyses over a period of several years required for informed decision-making on any (future) control measures that may be necessary?

- Which business units are exposed to transitory risks? Should sustainability requirements be made and communicated to customers?

- Critical dialogue with stakeholders: Should customers be required to comply with the recommendations of the Task Force on Climate-related Financial Disclosures (EU) or the German Sustainability Code in their publications?

- How can the availability of adequate numbers of appropriately qualified personnel and other resources to meeting the new challenges posed by sustainability risk be ensured?

Review of the risk strategy

- Which types of risk are affected by sustainability risks relevant to the specific business model?

- Country, regional, company or division-specific characteristics?

- Are risk types affected by sustainability risks specific to a company?

- Communication: The management’s defined approach to sustainability risks should be clearly communicated to its own management, employees, customers and investors.

- Role model function: Management should set a good example and thus prevent potential reputational risks at an early stage. Key question: Are the existing remuneration systems conducive to appropriate management of sustainability risks and, if a specific sustainability strategy is in place, are they in line with it?

Responsibility for strategy

- Responsibility for the business and risk strategy and its communication and implementation within the company (risk culture) lies with the management

- Management develops an understanding of significant sustainability risks, including physical and transitory risks, their characteristics and possible effects

Business organization

Holistic examination of the integration of sustainability risks into existing organisational guidelines. The content and level of detail are left to the discretion of the company within the framework of the minimum legal requirements.

Processes

- To examine whether and how sustainability risks can be integrated into the existing processes for lending / underwriting / investment decisions, risk diversification and controlling including activities of the governance functions and outsourcing.

- Review responsibilities and adapt organisational guidelines

- Risk control function ensures that sustainability risks are taken into account in the risk management system. Risk control function should report internally to management on the nature and extent of material company-specific sustainability risks.

- The compliance function is responsible, among other things, for monitoring the implementation of effective procedures to ensure compliance with legal requirements with regard to sustainability (including the EU Regulation on sustainability-related disclosure requirements in the financial services sector) and the voluntarily applied external sustainability standards.

- Legal and legal change risks must be checked, and the compliance function must evaluate them.

- Internal Audit function examines the appropriateness and effectiveness of the revised regulations on structural and procedural organisation, risk management and governance functions with regard to sustainability risks.

- Contingency planning must be checked to ensure that sustainability risks are adequately taken into account.

My assessment

- The Guidance from BaFin provides practical questions and guides you through the different aspects of sustainability. Risks related to sustainability are not seen as a new type of risk. They are only subsumed under the known major risk types (counterparty-, market price, operational-, liquidity-, strategic- and insurance risks).

- New standards are not set so far, the Guidance is so far voluntary and a compendium of non-binding procedures (good practice principles) only, although future revisions will tell…

- The topic of sustainability is one of the most burning issues of our time, with consequences for every individual, whether private person or at a company level. All of us, including financial services providers, will have to take part in this to working towards achievement of the “Paris Climate Goals”.